On Wednesday, August 24, Biden announced his plan to forgive up to $20,000 in student loans per American borrower. So, who will be eligible and what does that look like?

Biden’s Plan to Cancel Student Debt

Joe Biden outlined his debt forgiveness plan in a speech at the White House on Wednesday, where he addressed the burden of student loans on many Americans, as well as the pandemic circumstances that informed much of his plan.

Generally, borrowers who earn less than $125,000 a year - or $250,000 for couples with joint incomes - qualify for $10,000 in debt forgiveness. For Pell Grant recipients, this number doubles to $20,000. The plan doesn’t discriminate based on degree - those with graduate, undergraduate, and Parent Plus loans can all qualify. Even current students are included in Biden’s outline, but their qualification is dependent on their parents’ income. The forgiveness plan also includes a pause on federal student loan payments, delaying payments until December 31. Many students and borrowers criticized Biden for this last-minute announcement, as the last pause on payments was set to expire on August 31. Before Biden’s official statement, students were left wondering whether they’d have to begin budgeting for payments once again.

Biden additionally placed an “income cap” on payments, hoping to ease the burden of repayment for lower-income borrowers. For undergraduate loans, monthly payments would be capped at 5% of a borrower’s discretionary income, rather than 10%.

While the plan is extended to all Americans in student debt, Biden acknowledged in his statements that the burden of student debt is “especially heavy on Black and Hispanic borrowers, who on average have less family wealth to pay for it.” Also on Wednesday, a White House administrator expressed hope that the plan will “narrow the racial wealth gap.”

Of course, Biden’s plan was met with very mixed reviews. While Biden technically followed through on his campaign promise to address student debt, many Americans believe that the $10,000 cancellation is not enough. Democrats originally pressured Biden to cancel up to $50,000 per student. While $10,000 is something, it still leaves many American borrowers in crushing debt.

However, Republicans dislike the plan for a different reason. They believe that Biden is punishing Americans who were able to pay off their student loans. Senate Majority Leader Mitch McConnell asserted that Biden’s plan is “yet another way to make inflation even worse” and that it will “reward far-left activists.” When a reporter questioned Biden about the fairness of the forgiveness plan, the President shot back, “Is it fair to the people who, in fact, do not own multi-million dollar businesses and see these guys getting all the tax breaks?”

Many Americans share these concerns, but they are particularly unfounded. Firstly, we should be happy when something good happens to Americans. If you are mad that someone else is in less crippling debt after obtaining a degree, the problem lies in your sentiments. Sometimes, good things happen to other people. You don’t always get a cookie.

More importantly, though, loan forgiveness will only have a minimal effect on inflation. Experts and economists estimate that any increase in inflation will be limited, and Biden asserts that the benefit for individual families is well worth it. Not to mention, many Americans misunderstand the process of loan forgiveness; borrowers who qualify for student debt cancellation will not be handed $10,000 out of the government’s pocket. Instead, their monthly payments will decrease to accommodate a lower amount of debt. The cash flow to the federal government will not stop.

We’re Avoiding the Problem

While Biden’s plan seems like a step in the right direction, it does not address the underlying problem at hand: college affordability.

Biden said it himself. While speaking at the White House, the President described how, “an entire generation is now saddled with unsustainable debt in exchange for an attempt, at least, at a college degree. The burden is so heavy that even if you graduate, you may not have access to a middle-class life that a college degree once provided.”

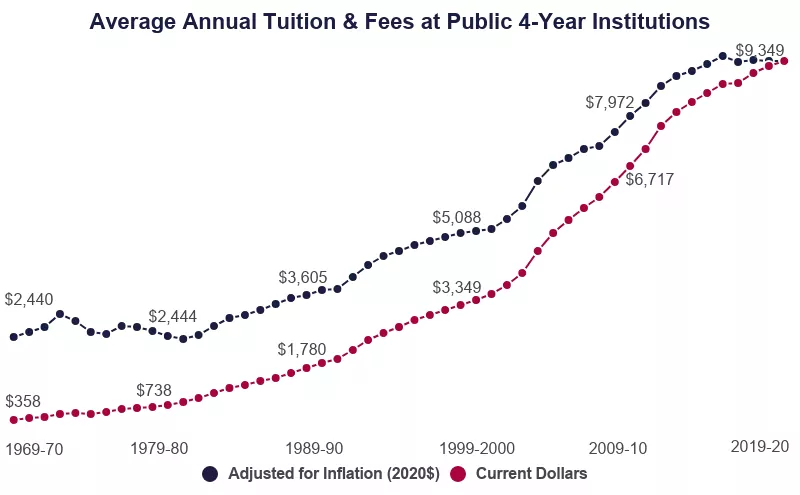

And he’s right. The cost of college tuition has risen at an insurmountable rate over the past few decades. For a 4-year institution, the cost of college tuition has increased by 179.2% over just the past 20 years. This massive jump leaves many American completely unable to overcome their student debt - 43 million Americans, in fact. Here we are worrying about inflation, when the rising cost of college outpaces the rise of inflation by 171.5%. Perhaps we should be more worried about our students, especially BIPOC and lower income students, who are disproportionately burdened by impossible college payments.

Education Data Initiative

In reality, Biden’s plan is a bandaid on a gunshot wound. The cancellation of $10,000 in student loans just this once will cost the government almost $300 billion, but it still doesn’t fix the quickly growing tuition costs that will burden future students. And, as predicted by the Committee for Responsible Federal Budget, the canceled student debt will return to America’s outstanding balance in just four years.

In addition to canceling student loan debt, we should be addressing the ludicrous cost of college and how to make affordability possible.